September 12, 2025 | 03:43 pm

TEMPO.CO, Jakarta - Finance Minister Purbaya Yudhi Sadewa announced plans to transfer Rp200 trillion from the government's account at Bank Indonesia (BI) to six state-owned banks (Himbara) on September 12, 2025. This amount constitutes half of the government's funds deposited in BI.

According to Purbaya, the process of transferring the deposit can be done swiftly. "It should be fast. Tonight I will sign it, and tomorrow the funds will enter the banks (Himbara)," he said at the DPR building, Jakarta, on Thursday, September 11, 2025.

This initiative is taken to support banks in channeling credit and driving the economy.

Bank Indonesia noted that banking credit recorded 7.03 percent growth year-on-year (y-o-y) in July 2025, marking a decline from 7.77 percent in June, and a fifth-month drop since March.

Transferring Funds to Himbara Poses Risks

Economist at Andalas University, Syafruddin Karimi, said the Indonesian government should anticipate several risks associated with this policy. "First, there's a risk of liquidity parking in Government Bonds (SBN) and Bank Indonesia Rupiah Securities (SRBI), so there's no significant growth in the credit," he told Tempo.

According to Syafrudin, this can be seen from the strong inclination of banks to place funds in government bonds and the growing ownership of SBN by banks, reaching around Rp1,318 trillion as of August 2025. Last July, Bank Indonesia revealed that banks tend to place their liquid funds in government bonds and are overly cautious in promoting credit.

Another risk, according to the lecturer at the Faculty of Economics and Business at Andalas University, is the moral hazard, where the banks will neglect quality. State-owned banks are feared to channel as much funds as possible to meet the government's targets, but the quality of credit receives less attention.

To achieve the goal, according to him, the government must take several steps, such as activating transactions outside the credit line, accelerating state budget spending to keep the money circulating, encouraging consumption through available incentives, such as the PPN-DTP for housing, targeted cuts in public service tariffs, and programs for food assistance or transportation that trigger daily transactions.

The government is also urged to align its policies so that Bank Indonesia does not reabsorb the liquidity, thus reducing the cost of funds. Establish targets, realization deadlines, and withdrawal or clawback sanctions for banks that withhold funds. The government also needs to issue a public dashboard monitoring effective interest rates, new credit, and workforce absorption.

"This accompanying package will push the Rp200 trillion to move swiftly from the government's account to the hands of workers, suppliers, and consumers," he said.

Previously, Minister Purbaya stated that he had already spoken with Himbara banks to refrain from using the government's account funds to purchase SBN and SRBI and to channel them to the public in the form of credit. He has also lobbied BI not to reabsorb the funds.

Himbara consists of several banks, including Bank Mandiri, Bank Rakyat Indonesia (BRI), Bank Negara Indonesia (BNI), and Bank Tabungan Negara (BTN), as well as Bank Syariah Indonesia (BSI) and Bank Syariah Nasional (BSN).

Meanwhile, Bank Mandiri sees the placement of the government's excess budget balance (SAL) in the banking system as potentially strengthening Third Party Funds growth while driving credit disbursement.

"Quoting the analysis of the Bank Mandiri Economists Team, this condition will support healthier liquidity availability and increase the effectiveness of monetary policy transmission, to drive an optimal money circulation," said Bank Mandiri's Corporate Secretary M. Ashidiq Iswara on Thursday, September 11, 2025.

Editor’s Choice: Finance Minister to Disburse Rp200 Trillion to Indonesia's State-Owned Banks

Click here to get the latest news updates from Tempo on Google News

Finance Minister to Disburse Rp200 Trillion to Indonesia's State-Owned Banks

20 jam lalu

The Finance Minister, Purbaya Yudhi Sadewa, ensures the transfer of Rp200 trillion government funds from BI to six banks will start on September 12, 2025, to boost credit and the economy.

Retail Sales in Indonesia Expected to Slow in the Next 3-6 Months

23 jam lalu

A recent survey by Bank Indonesia reveals retailers' expectations for retail sales in the next three to six months are slowing down.

Prabowo Approves Rp200tn Injection from BI Deposits to Support Lending, Growth

1 hari lalu

The government funds of Rp 200 trillion in Bank Indonesia approved by Prabowo to be withdrawn will be channeled to the banking sector.

Bank Indonesia Reports Falling Consumer Income and Surge in Debt Payments

1 hari lalu

Bank Indonesia presented the financial condition of Indonesian consumers. Income allocation for consumption decreased while loan payments increased.

Economist Outlines Three Risks of Indonesia's Burden Sharing Scheme

2 hari lalu

A new burden sharing scheme, jointly agreed upon by Bank Indonesia and the Finance Ministry to finance the government's programs, has drawn criticism.

Indonesians Remain Pessimistic About Job Availability, BI Survey Reports

2 hari lalu

A survey conducted by Bank Indonesia (BI) indicates that the public remains pessimistic about job availability.

The Wealth of Finance Minister Purbaya Yudhi Sadewa, Sri Mulyani's Replacement

2 hari lalu

Based on the LHKPN downloaded from the KPK website, Purbaya's wealth in 2024 amounted to Rp 39.2 billion. What are the details?

Prabowo Orders Acceleration of National Priority Programs Implementation

2 hari lalu

Indonesian President Prabowo Subianto has instructed the acceleration of all programs' implementation without any obstacles due to paperwork reasons.

YLBHI Slams Indonesia's New Finance Minister's Remark on "17+8" Demands

3 hari lalu

YLBHI slams Finance Minister Purbaya Yudhi Sadewa's statement on the 17+8 People's Demands as inaccurate.

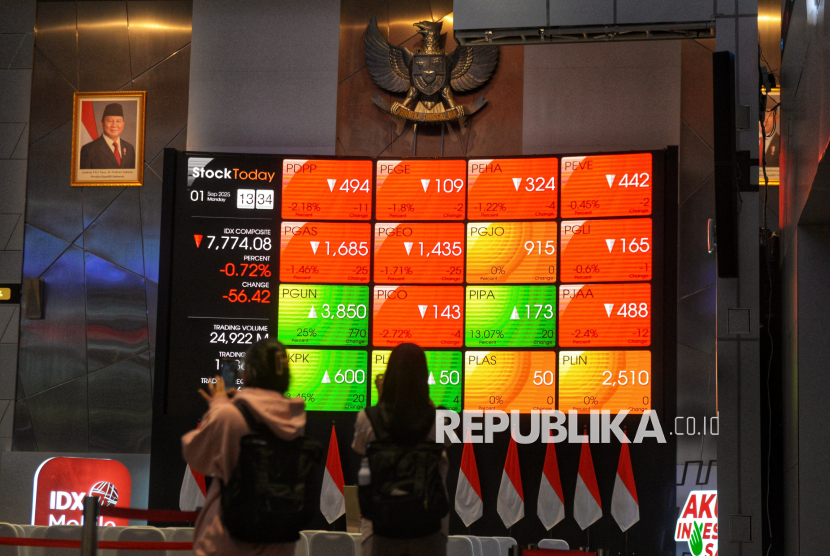

Indonesia's Stock Index Opens in the Red Zone After Prabowo Replaces Sri Mulyani

3 hari lalu

The Stock Exchange Composite Index (IHSG) opened in the red zone today, following the recent Cabinet reshuffle by President Prabowo Subianto.